Payment Gateways and Payment Buttons in Venezuela

A payment gateway is a technological infrastructure that facilitates and manages online financial transactions, enabling businesses and merchants to receive payments from their customers through various methods like credit cards, debit cards, bank transfers, among others, securely and efficiently.

In the specific context of Venezuela, a payment gateway refers to a platform or service that enables businesses in the country to accept payments for goods and services they offer, adapting to the peculiarities of the Venezuelan market and the limitations or restrictions within the country’s financial system. In a Venezuelan environment, an effective payment gateway is one that provides options tailored to the specific circumstances of the local economy, such as accepting various forms of payment, including national methods like Pago Móvil, as well as international options. It should also consider limitations related to the availability of currencies and access to international financial services.

Payment Gateways in Venezuela

- Mobile Payment C2P

- Biopago formerly Cle/IPG from Banco de Venezuela

- Banco Mercantil

- Banco Venezolano de Crédito (BVC)

- Mega Soft

- InstaPago

- Sitef

- Zelle

- Binance Pay

- Paypal

- AirTM

- Zinli

- Conclusions and Recommendations

- Integration with Wordpress/WooCommerce and Prestashop

Mobile Payment C2P

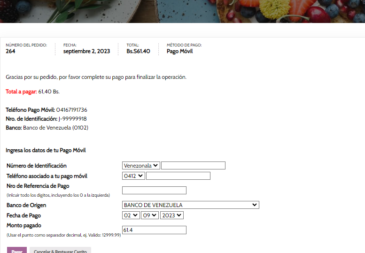

In the financial context of Venezuela, Mobile Payment has experienced significant evolution, moving from being a tool focused on transactions between individuals (P2C) to a broader modality known as Commerce to Person (C2P). Initially, Mobile Payment facilitated agile transactions between individuals, using only a mobile phone and an identification card to carry out transfers.

Mobile Payment in its C2P modality, or Commerce to Person, has brought a fundamental innovation that has revolutionized the way companies receive payments from their customers: the dynamic key.

Picture this: in addition to standard data such as ID card, mobile phone number, and bank, the C2P modality requires the client to obtain a dynamic key from their bank. This key, essential to validate the payment process, enables companies to close commercial operations promptly.

The introduction of the dynamic key has simplified processes for companies and streamlined commercial transactions. Now, merchants can receive payments from their customers without them having to do it, as the same commerce carries out the charge with the customer’s dynamic key.

Mobile Payment C2P is shaping up as a revolutionary tool that streamlines and simplifies commercial transactions in Venezuela, offering greater flexibility and agility to companies and their customers.

This key, essential to validate the payment process, can only be used once, regardless of the success or failure of the operation and can be requested as follows in the main banks:

- Banco de Venezuela: Send an SMS to 2662 with the words “CLAVE DE PAGO” from the number affiliated with Mobile Payment.

- Banesco: Send an SMS to 2846 from the number affiliated with Mobile Payment with the words “clave dinámica”, the ID type (V or E), and the ID number (Example: “clave dinámica V 11222333”).

- Banco Mercantil: Send an SMS to 24024 with the word “SCP” from the number affiliated with Mobile Payment.

- Banco del Tesoro: Access the Tesoro Pago Móvil APP or send an SMS to 2383 with the format “comercio TIPO_CEDULA CEDULA COORDENADA”.

- Bancamiga: Access the Bancamiga Suite APP and locate the OTP key option.

- Other Banks: Request information from a bank support operator on how to obtain a payment key for C2P.

This update has opened opportunities for businesses of all sizes, providing flexibility and speed in commercial transactions. Now, businesses, regardless of their size, can benefit from the agility and convenience offered by Mobile Payment C2P in their daily operations.

This payment method can be used with: Banco Mercantil, Banco Venezolano de Crédito (BVC), and Mega Soft.

Biopago ex-Cle/IPG from Banco de Venezuela

Biopago ex-Cle/IPG is a practical payment solution offered by Banco de Venezuela. This option allows transactions between individuals and legal entities of the same bank.

This payment method exclusively accepts Visa and Mastercard credit cards issued in Venezuela and transfers between accounts of the same bank with just one SMS-sent key at the time of execution of the charge.

Its functionality simplifies the transfer and payment process, especially between customers and businesses affiliated with Banco de Venezuela.

Integration Biopago for WooCommerce – Integration with Biopago for Prestashop

Banco Mercantil

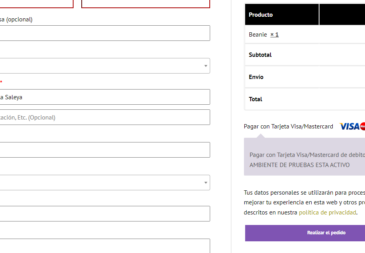

The payment gateway of Banco Mercantil offers a complete solution for online transactions. It allows merchants to offer multiple fundraising options to their customers through their APIs. They provide access only to legal accounts with more than 6 months of history and have demonstrated sufficient account movements, requiring an interview to validate all technical and legal requirements.

This platform accepts credit cards (from any national and international bank), debit cards (exclusively debit cards from Banco Mercantil customers), and Pago Móvil C2P. This makes it a versatile option compatible with different payment methods, beneficial for users seeking flexibility and various alternatives for their transactions.

Integration Mercantil for WooCommerce – Integration with Mercantil for Prestashop

Banco Venezolano de Crédito (BVC)

The online payment platform from Banco Venezolano de Crédito offers a comprehensive solution for fundraising in the market. It allows any merchant to offer various payment options to their customers through their APIs.

This solution includes accepting credit cards (from any national and international bank), debit cards (exclusively with BVC accounts), and Pago Móvil (both classic and C2P). By offering a range of diverse payment options, it is a robust alternative for merchants looking to diversify payment methods available to their customers.

Consider this option if you have an account at Banco Venezolano de Crédito, as it offers a wide range of both national and international payment methods.

Integration Banco Venezolano de Crédito for WooCommerce

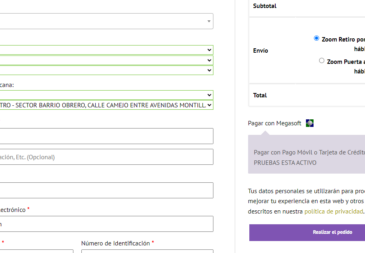

Mega Soft

The integration of the payment gateway Mega Soft provides a flexible and automated solution for payment validation. This solution is exclusively offered to merchants with legal accounts in any national bank and is designed to accept multiple forms of payment.

Through a Universal API, Mega Soft allows acceptance of Pago Móvil C2P/P2C, national and international credit cards, Zelle, and other payment methods. This diversity makes it an attractive option for merchants aiming to offer various payment options to their customers, ensuring convenience and flexibility in transactions.

Integration Mega Soft for WooCommerce – Integration with Mega Soft for Prestashop

InstaPago

InstaPago is a payment gateway platform that offers the possibility of exclusively conducting transactions through credit cards. This payment option requires users to have a legal account at Banesco or Mercantil banks to use it.

Although limited to national and international credit cards, this payment gateway offers a simple and direct interface for transactions. While its scope is restricted to specific legal accounts in these banks, it is a convenient option for those seeking to process payments using credit cards in their businesses.

Its focus on simplicity and integration with Banesco and Mercantil banks offers a specific alternative for those having these accounts and wishing to leverage them.

Sitef

Sitef operates similarly to InstaPago, offering the possibility of conducting transactions exclusively through credit cards; however, it is limited to transactions exclusively with accounts at Banco Mercantil.

Zelle

Zelle is a popular electronic transfer option that allows quick and easy person-to-person payments. While not a traditional payment gateway, its widespread use and integration with various platforms make it a reliable option for direct transfers between individuals and businesses with bank accounts in the United States.

Integration Offline Payments for WooCommerce

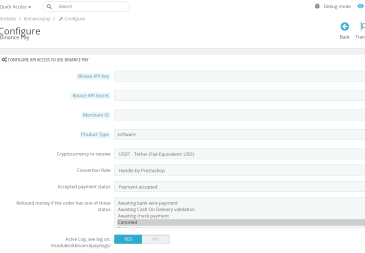

Binance Pay

Binance Pay is a payment platform developed by the renowned cryptocurrency exchange Binance. It operates through the stable cryptocurrency USDT (Tether), a digital currency that replicates the value of the US dollar, offering stability and reliability in transactions.

USDT, also known as Tether, is a cryptocurrency anchored to the value of the US dollar, meaning that 1 USDT is always approximately equal to 1 dollar. This relative stability to a fiat currency makes it an attractive option for daily and commercial transactions.

Binance Pay requires users to have a verified merchant account, preferably legal or with a personal signature, to access its services. This involves a more rigorous verification process but provides an additional layer of security and trust in transactions.

Integration Binance Pay for WooCommerce – Integration Binance Pay for Prestashop

PayPal

PayPal is a global online payment platform that, while accepted in Venezuela, has raised some concerns among users due to account and fund blocks. Despite being a popular and widely used option, some users have experienced difficulties with the service in terms of fund withdrawals, as it requires a bank account in the United States for such transactions. This limitation has led some Venezuelans to seek other alternatives to avoid potential inconveniences.

AirTM

AirTM is a platform that has shown effectiveness and functionality in the country. It allows exchanging various currencies and has been a useful alternative for transactions in Venezuela. However, it is important to note that its operability may vary depending on the platform’s internal policies and its availability in the country.

Integration Offline Payments for WooCommerce

Zinli

Zinli is a Panamanian Wallet operating in dollars, allowing transfers between accounts via email. Additionally, it offers a debit card facilitating both online and in-person purchases. This versatile platform enables users to manage their funds swiftly and conduct transactions effortlessly, making it a practical choice for operations in both digital and physical environments.

While Zinli is originally from Panama, it’s available for Venezuelan users, allowing them to benefit from its services and advantages, such as handling transactions in dollars and making transfers.

Integration Offline Payments for WooCommerce

Conclusions and Recommendations

When choosing a payment method, considering various factors is crucial. For those with legal accounts in Mercantil or BVC, these platforms provide more integrated options. If the legal account isn’t with any of these banks, BVC is less bureaucratic. Moreover, for those seeking alternatives, Mega Soft is a flexible choice as it accepts any national bank.

Regarding Zelle, AirTM, Zinli, and Binance Pay, each has its particularities. Zelle stands out for its quick transfers, AirTM offers currency exchange options, Zinli facilitates payments through email, and Binance Pay utilizes USDT, a cryptocurrency. However, to use Binance Pay, a verified merchant account, preferably legal or with a personal signature, is required.

In summary, the choice of payment method depends on specific needs. For those seeking uncomplicated options, conventional banking options are ideal. Those inclined towards cryptocurrencies might consider Binance Pay, provided they have the appropriate verification.

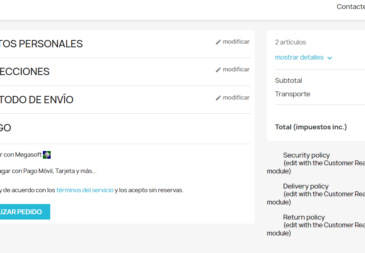

Integration with Wordpress/WooCommerce and Prestashop

In our commitment to simplify online payments, we offer a membership plan unlocking a range of options for you. With a membership cost starting at $6 per month, you’ll get complete access to all our plugins on a single domain. This special membership includes integrations for WordPress/WooCommerce and PrestaShop.

Our mission is to streamline the payment process for your business. That’s why we’ve integrated a wide variety of payment gateways, from traditional banking solutions to innovative digital options like Binance Pay. This diversity provides you the flexibility to adapt to your customers’ preferences and expedite your online transactions.

Our payment platforms are secure and user-friendly. With them, you can quickly and easily accept payments from your customers, providing them with a payment experience that suits their needs.

If you’re looking for a secure and direct way to receive payments, our payment gateways are the answer. Get our services today and start receiving payments within minutes.